The growth of the energy attribute certificate market in the past years has attracted more market players from across the entire supply-chain. More corporations and suppliers enter the market directly and source their electricity consumption in the unbundled market.

Having more participants in the market, i.e. for Guarantees of Origin, is great for the diversity of companies and the liquidity in the market, it also provides a new challenge: trading counterparties do not yet know each other and have to start an administrative onboarding procedure before completing a trade; credit lines may need to be established.

These procedures are all in line with risk compliance in order to protect a trading company from too much credit exposure from or towards another company. This is a common practice in the electricity trading market and we see more counterparty- and credit lists appearing separately for EACs as well. Onboarding new companies can be time-consuming that should be spend on trading instead.

Credit matrix for EACs

Counterparty and credit lists are a must-have for trading companies who wish to remain in control with who they can trade and how much credit exposure they are currently having based on deals they have made with one another.

On the Commerg Trading Platform for EACs you can see all the bids and offers that other companies have placed. If you haven’t shared your credit list with us, all numbers on the trading platform will appear in red which means that a potential trade will be subject to counterparty approval, credit check & contract at minimum.

Since 2013 we’ve continuously developed the Credit Matrix to help you out with visualizing which companies are good to trade with on the Commerg Trading Platform. Here’s how it works:

1. You can provide us with a credit list or a list of approved counterparties

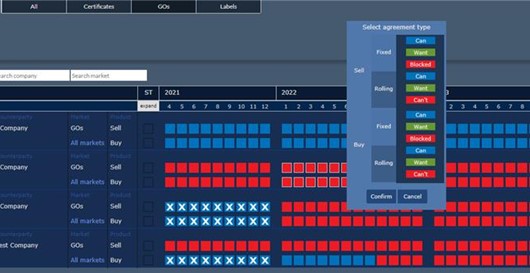

2. We give your risk department access to the Credit Matrix. Here they can select which companies are good to trade with for their trader. It looks like this:

For each company that already has credit lines with you, your Risk Department can select up to several years ahead in what manner they can currently trade with you.

3. Bids or offers that are coming from good names will now appear in green, clearly indicating which numbers are safe for you to trade.

Benefits of using the credit matrix

1. You don’t risk trading with a company that you have not set up yet. You credit risk is under control;

2. Your Risk Manager controls: he updates brokers and traders he selects;

3. All the above benefits are saving you time that you can invest in trading again

4. You get access to www.creditmatrix.org and can enjoy its intuitive and easy-to-use features.

If your company would like to see for yourselves how it works, reach out to us via info@commerg.com or +31 10 30 200 50. We’ll be happy to show you how it works.